Stocks on sale after the coronavirus crash

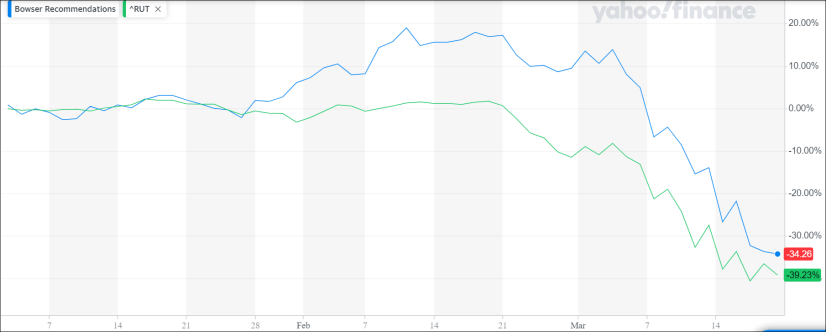

There’s no denying that the coronavirus outbreak has left small cap stocks in shambles. While Bowser stocks have been outperforming major indices, many of them have still sold off quite a bit. Even companies that don’t expect to lose business are still losing plenty of market value. Below is a year-to-date (YTD) chart of how Bowser recommendations have performed in comparison to the Russell 2000 Index:

Since we focus on companies with strong fundamentals, we’re not used to seeing this kind of volatility. However, because of their market correlation, most of our recommendations have pulled back.

Discounts

Just because a stock has pulled back doesn’t mean it offers an appealing entry point. So which Bowser stocks are on our radar after selling off?

Of the three listed stocks, two have had some incredible returns over the past few years. RADA shares gained as much as 127% since the start of 2018 and recently dropped 55% in just two months. LSYN shares gained 148% over the same time period and is down 41% in one month. Although these pullbacks may seem substantial, it’s common for growth stocks to selloff during volatility spikes.

Neither RADA nor LSYN are undervalued, but offer great opportunities under $3 per share. In fact, one of the guidelines in our Game Plan is to never pay more than $3 for a penny stock. This helps you avoid overpaying and makes you focus on stocks with much better risk-to-reward ratio.

RADA is one of our favorite stocks because of its high year-over year revenue growth rate of 58% and huge increase in demand across all business segments. The company also stated that the COVID-19 outbreak is not negatively effecting its business and reaffirmed outlook. LSYN is another one of our preferred growth stocks due to its recent focus on creating shareholder value and maintaining growth. The podcast industry is booming and LSYN is one of the leading companies that’s actually turning a solid profit and generating organic growth.

Dividend

We’ve included LOAN on our list due to the value it can generate over time. Many of our subscribers have had tremendous success with this stock in the past. This is mainly a result of its undervaluation, asset efficiency, and high dividend yield of 12%. Yes, you read that correctly, 12%! That kind of dividend combined with the recently announced share repurchase program puts this stock at the top of our list. The only issue is that it’s currently trading above $3, but if the markets continue to drop then it will likely come back into buying range.

Conclusion

All in all, there are plenty of discounts surfacing because of the market volatility. Instead of trying to jump ship after the initial selloff, consider adding some diversity to your portfolio with some of our top stocks. Many of our recommendations have taken a hit during these trying times, so put your cash to work!

I’m a little surprised that FPAY has taken the hit that it has…considering their business I thought they would have held up better…just a thought

What do you think about TAIT now?

Any growth stocks get hammered harder during market volatility. I like TAIT a lot but seems that it might be a little bit of a stale stock. Want to see share price start moving up slightly as odd as that sounds… just to show that there’s still demand for it. Didn’t see these comments before replying in the forums. All tickers that you’ve mentioned are great companies Chris.

Two comments about the new terrible 10 list. I was planning on buying all ten and splitting up $2k, but the first one CHS is already up to $1.65 and is retail. I skipped that one. I skipped the second one also because it is a LP which provides k-1 forms for tax time and I hate them. My experience with them is that they are mailed out early April or late March and I do not want to wait for these ridicules long terrible forms. They are very complex and I hate even inputting into Turbo tax. Please warn your readers about this stock. can you provide me with time number 11 and 12? By the way, the 2009 terrible 10 list included the company that I retired from after 36/years and tat was Unisys (UIS). It did rebound nicely.

Duly noted, thanks Dennis. MOGU (China stock) and ETM (broadcasting) were numbers 11 and 12. That’s great to hear though! Let’s see if one of these turns into UIS.

I am new to this group and stocks.I like what i see so far and invested a small amount into the terrible ten and i also invested into a few “stock of the month” picks.What started me is interest in some good crude oil stocks.Does anyone have any suggestions on crude oil stocks worth investing in?

James, we have not identified any oil companies that meet our criteria for recommendation. We’ve featured a number in the past, but they have fallen out of the newsletter for one reason or another. There are a number of ETFs that can be looked into as well. An example is USO. Keep in mind that we do not recommend ETFs through The Bowser Report, and that crude oil has been very volatile recently.

I am interested in your Beginners Portfolio, but I do not fully understand it. Are you going to start a new one in the new year? Could you do a feature article on the portfolio and explain it in detail.

Thanks

Chet

Chet, good question. It’s a portfolio that we started in 2001 and have tracked over time to show the long-term performance of a portfolio. It’s simply meant to demonstrate how to manage a Bowser portfolio using the Game Plan. It’s not intended for anything beyond that.

For annual performance, we update the previous year’s pick performance each January (as we did in our most recent January 2021 newsletter).

I think the Bowser Report does a great job on covering company stocks. I look forward to reading your newsletter again. Because I enjoy reading about companies making a profit. The company stock watch list (beginner’s portfolio) is immensely helpful. I am thinking about subscribing again to your Bowser Report. Maybe you can write a column about a company BIOL (biolaze).